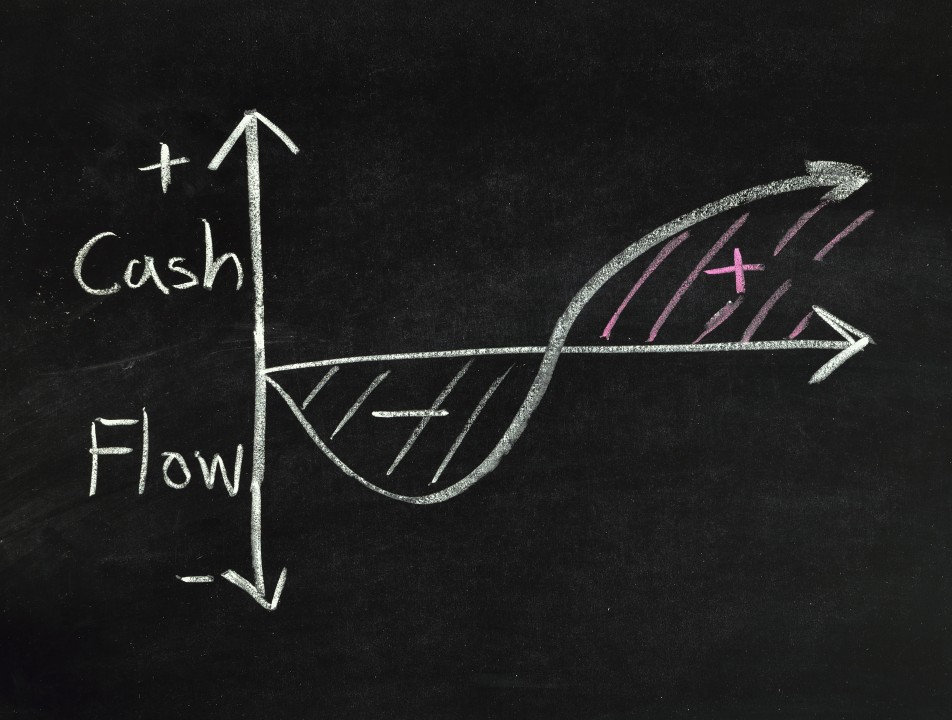

I hope differently of course, but perhaps also your company has been hit hard by the Covid-19 crisis. You were forced to take all kinds of measures to ensure the future of your company. Sales has gone down drastically, while a lot of costs are recurring every month. Even if no more cash comes in, suppliers still have to be paid and loans have to be settled.

Try to avoid cutting costs that are essential to serve your customers correctly

One way to keep your cash flow under control, is to reduce expenses. Cash in has decreased drastically, so cash out has to follow. Clear. However, a lot of cost items such as rent, interest on loans, IT infrastructure, wages, etc. simply are not directly related to sales volumes. So you might have to cut in these costs as well to survive in the short term. But if you still have a little buffer, try to avoid cutting costs that are essential to serve your customer correctly. Ask yourself some questions. Can I still respond to my customers inquiries if I dismiss a number of sales people? Can I still deliver the right quality if I switch to cheaper raw materials? Can I deliver my customers in time if I lay off my transport planner? After all, the long-term success of the company depends on all these kind of things since it costs much more to convince new customers than to keep the existing ones.

Cutting costs as described in the paragraph above can have a positive cash impact, but this is not always the case. If laying off a person means you have to keep on paying for a couple of months, then you will only see the positive cash effect after this period. Therefore some other actions are typically considered to increase cash flow in the short term. Both on the supplier side as on the customer side you could renegotiate payment terms in order to get your money faster and to pay your invoices later. However, in the current crisis, it is likely that both your suppliers and customers are experiencing the same problems as you are. They might get the feeling that you are simply passing on your problems and therefore no longer see you as a trustworthy partner.

Reduce inventory, but maintain your customer service level as much as possible

You could also try to reduce your inventory, which would have a positive impact on your cash balance. If you temporarily buy or produce less than you sell, your inventory will decrease. Sounds good… but let’s take a closer look at this. A substantial part of inventory usually consists of obsolete and slow moving stock. Since this part of your inventory is (almost) not moving, it will not decrease very quickly if you stop purchasing. In other words, not an ideal stock category to gain cash on the short term. The other part of inventory, are fast movers. Your inventory will go down more rapidly if you temporarily purchase or produce less of these items. But the pitfall, of course, is that this is also the stock that your customers expect to be available. When decreasing fast mover stock, you increase the risks of empty racks while your competitor is able to deliver. So you may have solved your cash problem for some weeks or months, but you might also be compromising future sales because of decreased service levels.

To conclude I would say that cash flow management would be your first priority in this crisis situation, but when you have passed the first hurdle, think strategically again, think about all the efforts you had to make to acquire every one of your customers, and how important they are for the long term existence of your company.

If you want to discuss any of the ideas above, based on experiences in your company, feel free to contact me on tom.henderix@lemantis.ch or by phone on +41 79 326 85 65.

Leave A Comment